How to Simplify and Apply 'Your Money or Your Life' Principles for Financial Independence?

Have you ever wondered how to take control of your finances while living a life aligned with your values?

Your Money or Your Life by Vicki Robin offers a transformative 9-step program to achieve financial independence and freedom. It’s a guide that helps you understand your past financial habits, optimize your present spending, and plan for a secure future.

In this blog, I’m sharing two approaches to mastering the lessons from this book: the original 9-step method and a simplified 3-step framework focusing on your past, present, and future.

Also, I’ve created Google Sheets templates to help you track your progress, take actionable steps, and gain clarity on your financial journey.

Whether you’re a fan of detailed systems or prefer a streamlined approach, this guide is designed to help you take charge of your money and, ultimately, your life.

Let’s explore these processes and make financial independence a reality!

I often think about this - what is the ultimate purpose and goal of this life? The book defines this beautifully:

The ultimate goal of Your Money or Your Life is to free up your time to focus on the things that truly bring you joy and fulfillment by achieving Financial Independence (FI).

This means reaching a level of financial security where your investments and savings generate enough passive income to cover your living expenses, making work optional rather than essential.

The Simplified 3-Step Process

The book emphasizes a detailed nine-step process, but I discovered a simpler and more intuitive way to remember and apply its principles.

By organizing the steps around a timeline—focusing on the past, present, and future—you can streamline the process while still achieving the same powerful results.

Don’t worry, I’ve included a detailed breakdown of all nine steps later in this blog for those who want a deeper dive into each one.

For now, let’s review and download this new, time-focused perspective!

The Original 9-Step Process

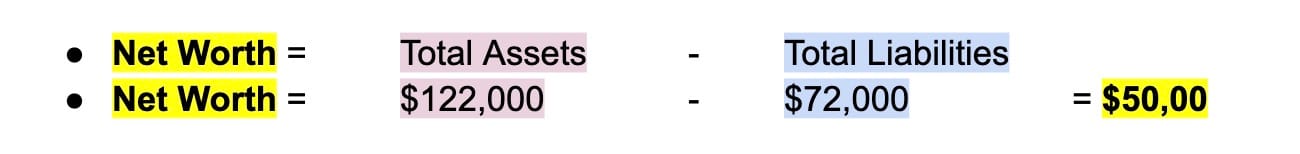

Step 1: Making peace with the Past

- How much money you earned in your life?

- What have you got to show for it?

There are two parts of this step:

- Find out how much money you have earned in your lifetime–-the sum total of your gross income, from the first penny you ever earned to your most recent paycheck.

- Find out your net worth by creating a personal balance sheet of assets and liabilities.

Step 2: Being in the Present–Tracking Your Life Energy

Keep track of every cent that comes into or goes out of your life

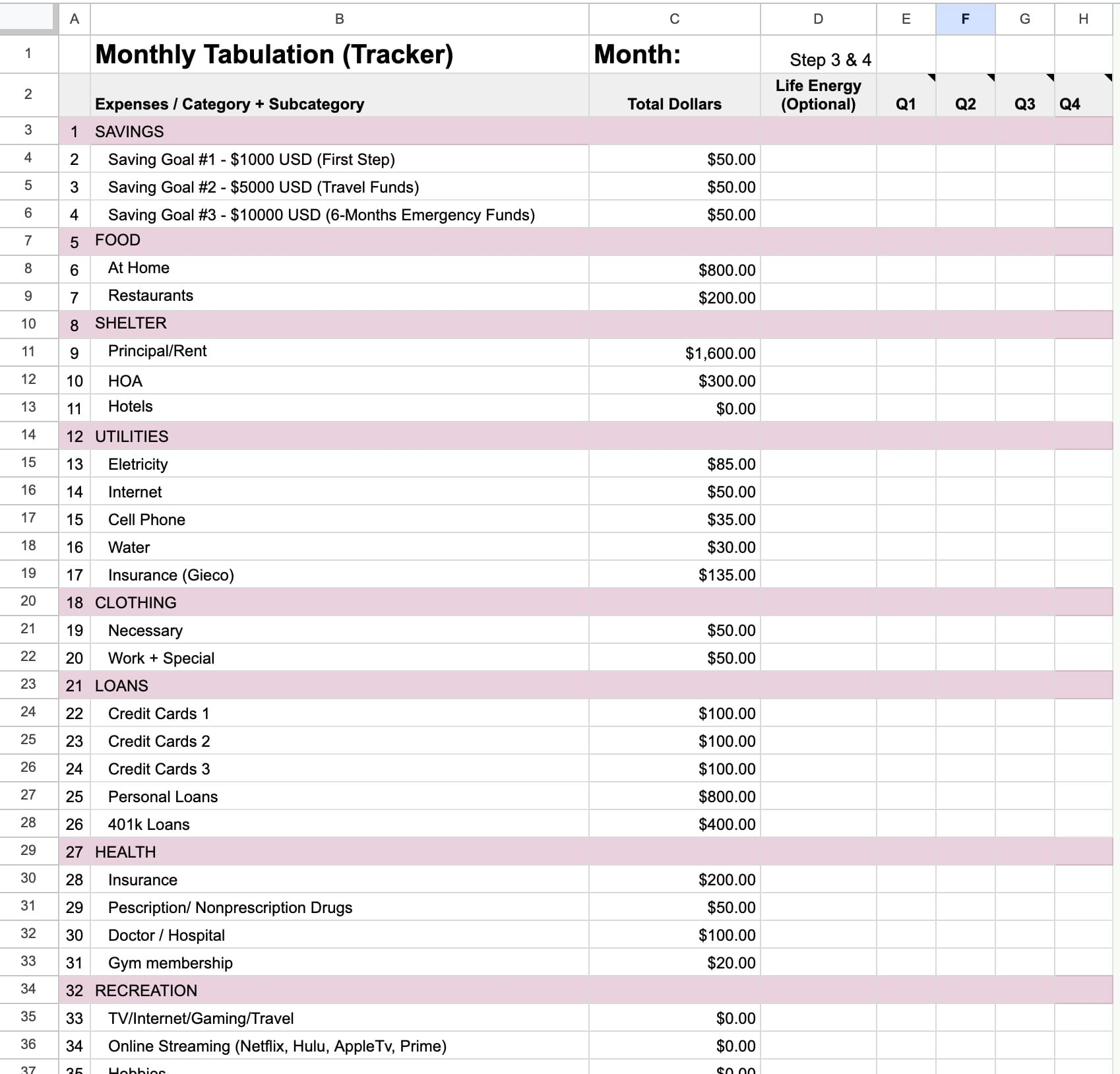

Step 3: Monthly Tabulation–Where Is It All Going?

Every month, total all expenses within categories generated by your own unique spending pattern. Then total income.

Step 4: Three Questions That Will Transform Your Life

On your Monthly Tabulation (Tracker), ask these three questions of each of your category totals expressed as hours of life energy and record your responses (add - or 0 or +):

- Q1: Did I receive fulfillment, satisfaction, and value in proportion to life energy spent*?

- Q2: Is this expenditure of life energy in alignment with my values and life purpose?

- Q3: How might this expenditure change if I didn’t have to work for money?

- Q4: What would expenditures in this category look like in a just and compassionate world where everyone had everything they needed for a life they loved, now and in the future?

*What is life energy?

Remember, money is your life energy. Every dollar represents time you’ve traded.

This journey isn’t just about saving—it’s about reclaiming your time and purpose.

Part two: What Is Purpose?

Purpose is the overarching goal that embodies our values and our dreams.

Purpose implies direction and time–you do something now to have something later that you value.

It’s a concerted intention to do something meaningful for both yourself and the world at large.

Purpose can be as straightforward as your goal.

“Life purpose,” however, implies something beyond “reason.”

It isn’t simply achieving a goal or acquiring some longed-for possession.

It is a chosen dedication of your life energy to something you believe is more important than your individual little existence.

It is your commitment.

It becomes your identify as surely as your name, your body, or your story to date–and can become more important than life itself.

You can see these different kinds of purpose—goal, meaning, and dedication—in this story about three stonecutters, each chipping away at a large block.

A passerby approaches the first stonecutter and asks, “Excuse me, what are you doing?” The stonecutter replies rather gruffly, “Can’t you see? I’m chipping away at this big hunk of stone.”

Approaching the second craftsman, our curious person asks the same question. This stonecutter looks up with a mixture of pride and resignation and says, “Why, I’m earning a living to take care of my wife and children.”

Moving to the third worker, our questioner asks, “And what are you doing?” The third stonecutter looks up, his face shining, and says with reverence, “I’m building a cathedral!” (dedication to a higher purpose).

How Do We Find Our Purpose?

- Work with your passion, on projects you care deeply about.

- Work with your pain, with people whose pain touches your heart.

- Work with what is at hand, with the opportunities that arise daily for responding to the simple needs of others.

Summary: Passion, pain, what’s at hand—these are doorways to finding a purpose beyond material acquisition.

P.S. I'd love to hear your thoughts, so please share them in the comments below. I can't wait to read and learn from your inspiring answers!

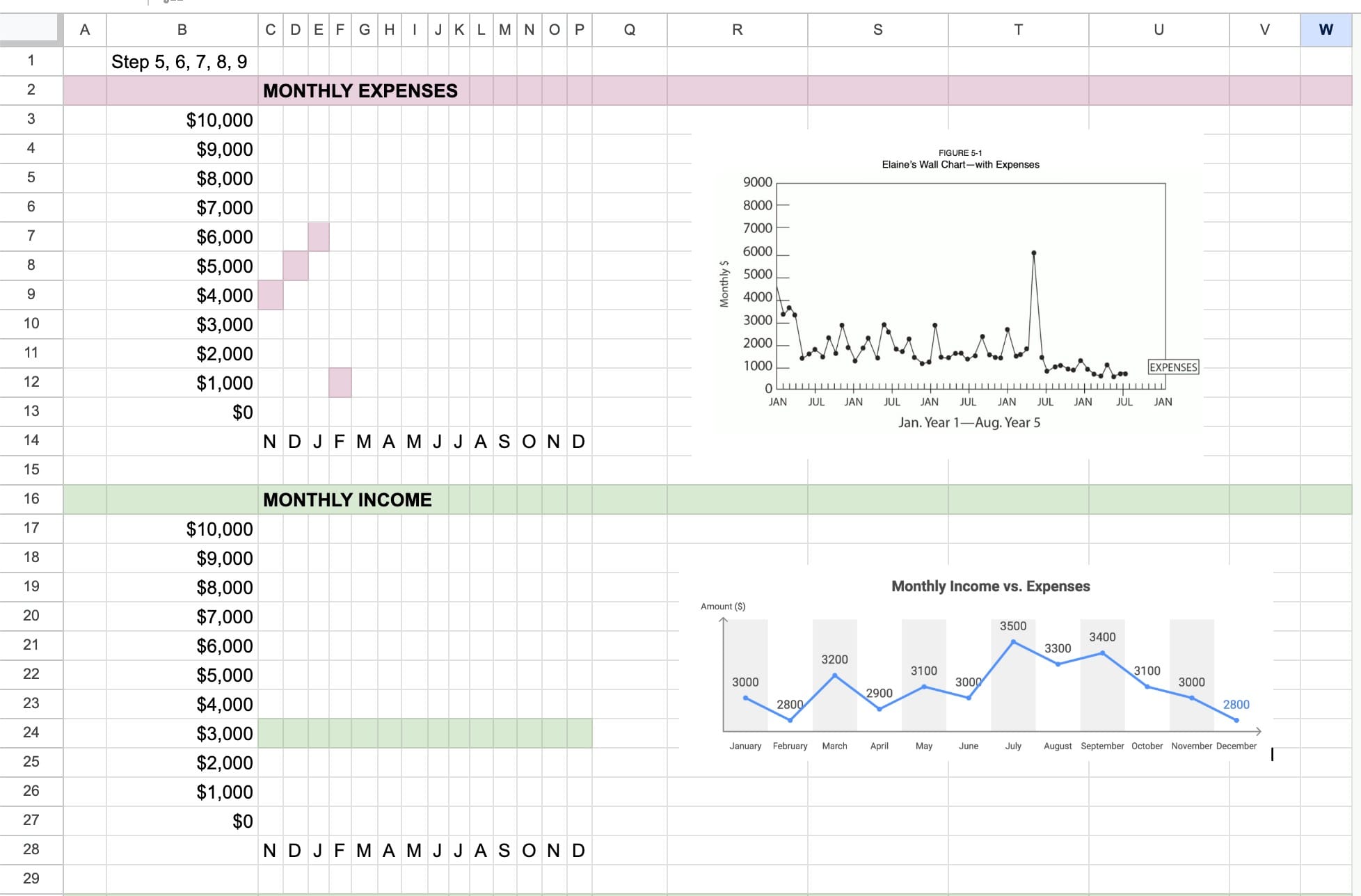

Step 5: Making Life Energy Visible

In step 5, you make visible the results of the previous steps, plotting them on a graph that gives you a clear, simple picture of your financial situation, now and over time, and the transformation in your relationship with money (life energy).

Step 6: Valuing Your Life Energy–Minimizing Spending ↓↓↓

Learn and practice intelligent use of your life energy (money), which will result in lowering your expenses and increasing your savings. This will create greater fulfillment, integrity, and alignment in your life.

This step involves the intelligent use of your life energy (money) and the conscious lowering or elimination of expenses.

One sure way to save money:

- Stop trying to impress other people

CHECKLIST: THINK BEFORE YOU SPEND

- Don’t go shopping

- Live within your means

- Take care of what you have

- Wear it out

- Do it yourself

- Anticipate your needs

- Reserach value, quality, durability, multiple use and price

- Buy it for less

- Meet your needs differently

- Follow the Nine Steps of this program

Taking Care of Your Body

- Medical costs are high, so staying well is good for your wallet as well as for your body.

- Your best basic health insurance is a

- healthy diet,

- exercise,

- good rest, and

- low stress.

- Prevention is key.

Step 7: Valuing Your Life Energy–Maximizing Income ↑↑↑

Increasing your income by valuing the life energy you invest in your job and exchanging it for the highest pay consistent with your health and integrity.

Growth potential, communication channels, interest in work, and recognition make a job satisfying–not pay.

- Redefining work:

- increases choices

- allows you to work from the inside out

- makes us life designers, not just wage earners

- adds life to your retirement

- honors unpaid activity

- reunites work and play

- allows you to enjoy your leisure more

- sheds a new light on “Right Livelihood”

Step 8: Capital and the Crossover Point

The Crossover Point provides us with our final definition of Financial Independence.

At the Crossover Point, where monthly investment income exceeds your monthly expenses, you will be financially independent in the traditional sense of that term.

You will have passive income from a source other than a job.

Step 9: Investing for FI (Financial Independence)

Become knowledgeable and sophisticated about income-producing investments that can provide a consistent income sufficient for your needs over the long term.

- Capital: The income-producing core of your Financial Independence

- Cushion: Enough ready cash, earning bank interest, to cover six months of expenses.

- Cache: The surplus of funds resulting from your continued practice of the nine steps

Thanks for reading!

I hope you enjoyed the 9 steps summary and my super simple 3-step process.

Don’t forget—you can grab the free Google Sheet. It’s all free for a limited time, so go check it out!

Get Your Free Google Sheets Template for Financial Independence!

For a limited time only, download the Your Money or Your Life Google Sheets template for FREE (originally valued at $9.99)!

Download Now:

Get Your Free Google Sheets Template for Financial Independence!

For a limited time only, download the Your Money or Your Life Google Sheets template for FREE (originally valued at $9.99)!

Benefits:

- Simplified 3-step process focusing on Past, Present, and Future

- Track your financial health with a Balance Sheet

- Monitor income, expenses, and savings with Daily & Monthly Trackers

- Visualize your progress with Charts & Graphs

How to Use:

- Click the link to download the file.

- Open the file and select "File" > "Make a copy" to save your own version.

- Enter your personal financial details and track your progress towards financial freedom!

This is a limited-time offer, so don’t miss out!

Feel free to share any feedback at write2muzammilkhan@gmail.com

I hope this simplified approach to Your Money or Your Life helps you take meaningful steps towards financial freedom with ease and clarity.

If you found this article helpful, then you’ll definitely enjoy my other two pieces on financial independence.

Be sure to check them out for more insights and actionable strategies to take control of your money and secure your future.

Happy reading!